DMIRS has released the Mine Rehabilitation Fund Data along with interesting statistics that can been seen in the report.

Mining Rehabilitation Fund (MRF) 2019 Data Release

Mining Rehabilitation Guidance

The data itself is a wealth of information and when joined with other tenement data in LandTrack Systems product LandTracker produces very interesting statistics.

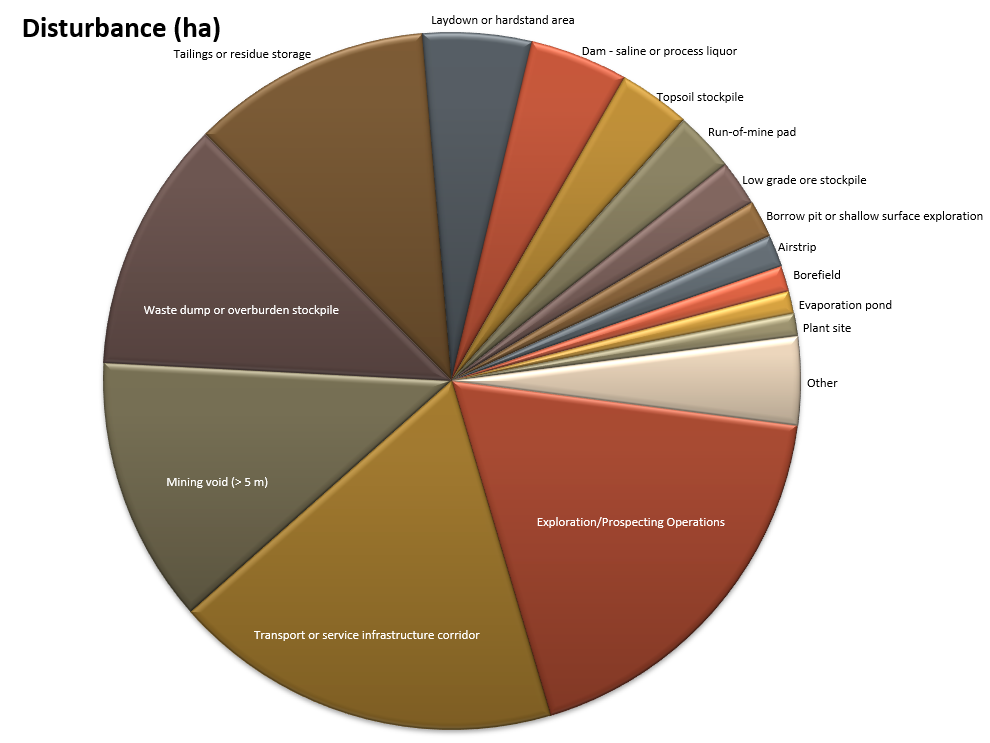

- Of the 264,600,000 hectares in WA only 138,203 is disturbed for the purpose of mining and exploration

- That is %0.037 of the area of WA is disturbed for the purpose of exploration and mining.

- Of that 24,000 hectares is transport corridors and

- There are 289 hectares of workshops.

If we look the statistics of a couple of sites and companies that are in the news at the moment using the following calculation.

Disturbance = (Disturbance hectares) x (Category Unit Rate) + ((Land Under Rehabilitation hectares) x (Category E ($2,000))) = Rehabilitation Liability Estimate (RLE)

MRF fee payable annually is 1% of the RLE

These calculations are relative easily and quickly arrived at (less than 5 minutes) by using LandTracker.

Boddington Mine

Boddington Mine only has a Rehabilitation Liability Estimate of $142,901,240 and pays $1,429,012 in MRF fees per year. It has 173 hectares of tailings under rehabilitation, which reduces the RLE by $8.6M.

Panoramic

Looking at the MRF data for Panoramic Resources is topical at the moment because Independence Group (IGO) has launched a hostile takeover. We can determine the extent of the environmental liability that IGO may inherit.

Panoramic Resources has a Rehabilitation Liability Estimate of $15,357,500 and $153,575 in MRF fees. Estimating environmental liability is now such a simple exercise if companies are reporting corectly.

Saracen’s 50% purchase of KCGM

Looking at the purchase by Saracen from Barrick of 50% of the Super Pit (held in the name of KCGM), KCGM has $103,251,000 Rehabilitation Liability Estimate and pays 1% of this amount for the MRF. Barrick’s share of this is 50%; a rehabilitation liability of $51,625,500. Barrick with the $1.1 billion sale price are ridding themselves of a significant liability.