If it wasn’t so tragic for the people involved, this story is a lesson on why to keep your documentation in order and do proper due diligence before entering a joint venture and not to fabricate expenditure when reporting to the DMIRS.

There is a couple of Wardens Court hearings where we can piece the story together; Henry v Heymans [2014] WAMW 8 where Heymans attempts to deny Henry has an interest in a mining lease the subject of their joint venture. A second case; Booy and Henry v Eastone Holding P/L [2021] WAMW 12 where Henry obtains an adjoining lease from Easton with a forfeiture application.

It all commenced in 1995 Mr Peter Heymans ‘gem expert’ and his wife Michelle Heymans are granted equal shares in Mining Lease 47/363 that contains a stone called Karratha jade, a rare gem stone (but is no relation to jade). It is chrome chalcedony in massive chert beds of extremely fine-grained quartz-sericite-kaolinite, with fuchsite, which colours the rock green, with quartz veins and quartz-chalcedony stringers.

Fifteen years late in 2009 Mr Peter Heymans finds a market in Thailand for this stone. He claims it is the largest known deposit in the world worth $1 to $2 billion, but he has no money and his wife has left him (who owns the other half of the mining lease at the time).

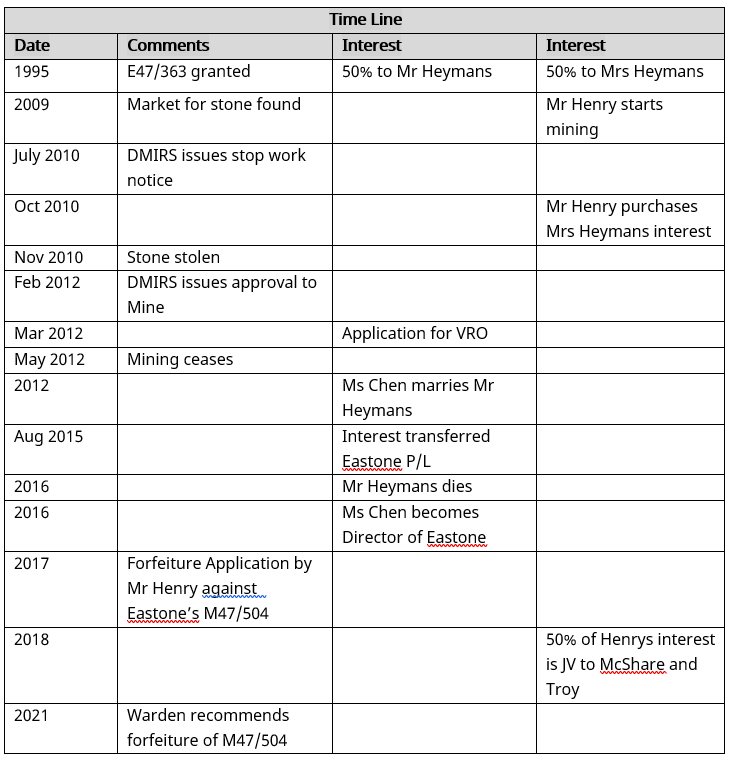

He requests Mr Henry and his son to begin mining the stone, without a mining approval from DMIRS and they fill 20 containers and ship them to Singapore. The District Inspector of Mines visits the site and issues a “clean up notice” and a “stop work notice” on the 27 July 2010, but Mr Heymans failed to mention this to the Mr Henry or his son (See the time line below for any clarification of dates).

Mr Henry sees a fortune to be made and makes an oral agreement with Mr Heymans that allows him to become an equal partner in the mining lease and they agree to share the proceeds and the cost of mining. Mr Henry’s would have saved himself a lot of heart ache and money if he completed a proper due diligence and documented their operating agreement.

On the 10 October 2010, Mr Heymans approaches Mrs Heymans to transfer her half of the mining lease to Mr Henry, which they do next day.

Mrs Heymans wants to rid herself of the mining lease and hands over a draft Transfer Form, with a number of mistakes, including the absence of a witness signatures for all parties executing the form. She also misdescribes the ‘consideration” (the amount to be paid) on the Transfer Form. It did not reflect the oral agreement between the Mr Henry and Mr Heymans (according to the Warden).

On the day of the execution, Mr Henry paid $13,200 for to Heymans for a DMP royalty (which was proved to be a false statement by Heymans) and a water account, and advanced another $1000 for Mr Heymans upcoming business trip to China.

On the understanding of the oral agreement Mr Henry was to pay all administrative costs for the mining lease. Though it ends up more than he bargained for, and included the cost of obtaining mining approvals, including the cost of producing an environmental report, $20,000 for a surety for a DMP Bond, all the clean-up expenses, and aboriginal heritage surveys of $3,500. In Nov 2010 he also engaged lawyer and travelled to Thailand in an attempt to recover sea containers with the stone.

Mr Henry commenced mining on the understanding that all the mining approvals from the DMP had been issued. They mined about 120 tonnes of stone, which was sent to China but never paid for. Though reading between the lines I suggest, Mr Heymans may have been paid and failed to pay Mr Henry his share.

The joint venture parties had a falling out over unpaid money and in March 2012 Mr Heymans attempted to obtained a VRO (Violence Restraining Order), that was unsuccessful, to stop Mr Henry bullying and threatening him for the money. Mr Henry was also attempting to stop Mr Heymans from mining while seeking the mining approval from the DMIRS as it would jeopardise the grant of the mining approval. In frustration Mr Henry also sought an injunction to stop Mr Heymans from mining on the lease while he was seeking approval for mining.

The approval to commence mining was issued February 2012.

It appears from the evidence presented at Henry v Heymans [2014] WAMW 8 that 30 tons of stone was mined between 2009 and 2010. On Nov 2010, 40 containers of stone was stolen from the Dampier port and sent to Thailand. Heymans was mining stone in 2011 and in May 2012 with 60 tons of stone being sent to China. The mining appears to cease when Mr Henry demanded a 50% deposit on the stone before shipping it and when the injunction was lodged to prevent mining.

Then from 2013 to 2015 Mr Henry lodges a series of seizure notices on the lease against Mr Heymans’ interest in the lease for unpaid debt, that were subsequently withdrawn.

During the period from October 2010 and March 2012 Mr Heymans claims he spent most of his time in China trying to sell the stone. Though during this time, he married Guizhi Chen and they both returned to Australia.

Peter Heymans on the 4th August 2015, transfers his share of the E47/363 to Eastone Holdings Pty Ltd.

When Mr Heymans died in 2016, Ms Chen became one of the directors of Eastone Holdings Pty Ltd. The other directors of the Eastone at the time was Jing Wang of Karratha, Li Ma of Tianjin City, and Dong Xiao Zong of Chengde City.

In May 2018, Mr Henry then joint ventures out a 50% of his interest in M47/363 to Mr William McSharer and Mr Mark Troy. Who in January 2019 lodge an Application for Forfeiture on the Lease which is dismissed by the Warden March 2019.

Mr Henry after being defrauded by his partner in the Lease is looking for compensation. So, he sees Eastone is in breach of the expenditure conditions of the Mining Lease 47/504, which is adjacent to M47/363. So, on the 4 May 2017, he and Mr Justin Booy lodged an Application for Forfeiture and the decision from the case was delivered 23 August 2021 (4 years later). The minimum expenditure on the tenement was $10,000 and Eastone claim they spent $20,123. They cannot produce any documentation to support the expenditure.

Mr Henry was residing on a miscellaneous licence L47/154 near to the M47/504 and he testified that he had never seen Ms Chen on the mining lease for a period of two years. Despite Ms Chen’s claims that she was metal detecting, sampling and dry blowing on the lease for a period of 144 hours in the year. Because, Ms Chen failed to provide any documentation, and the witness she used, both Mr Nissen and Mr Chen Rao could not reliably corroborate Ms Chen’s evidence and Warden O’Sullivan stated:

“I am of the view that the information in Ms Chen’s affidavit was not reliable” and “her evidence contained a number of inconsistencies”

Warden O’Sullivan went onto state:

“Eastone’s record keeping was so poor that when challenged it could not produce reliable evidence capable of demonstrating with any certainty of what was spent”

The Warden went onto recommend to the Minister that he forfeit M47/504.

One would think it obvious, and it is even more obvious in hindsight, there is much to be learnt from this saga to save yourself a lot of distress and money. Conduct a comprehensive due diligence on any assets you acquire. Document any agreements you have with another party when exploring or mining or any joint venture for that matter. Keep a good relationship with your partner so it doesn’t come back and bite you. Finally, accurately document your exploration and mining to support your reporting and compliance requirements.

To avoid making similar mistakes so you don’t lose your tenements, LandTrack Systems holds a number of courses.

Navigating Exploration Agreements – 18th and 19th Nov 2021

Understanding Tenement Expenditure – 25th and 26th Nov 2021

Practical Tenement Management – 17th and 18th Feb 2022

Please refer to our website for further information and if you wish to attend any of these courses.