Reporting expenditure to DMIRS is a common hurdle for small to mid-size exploration companies and prospectors. Made more complicated as DMIRS has a mandate to audit 0.7% of all tenements’ expenditure per year and if your accounts and processes are not up to scratch it can be an expensive exercise, potentially putting tenure at risk. This article may be stating the obvious but it is worth taking 5 minutes to read as the obvious is not commonly done, and can save a world of pain.

Tenement Expenditure

The Western Australian Government imposes a minimum expenditure commitment (calculated by a formula) on each granted exploration licence, prospecting licence and mining lease, which totals $543,133,478 across all of WA. With a requirement that the expenditure and exploration be reported annually through an Operations Report commonly known as a Form 5. There are approximately 16,700 tenements in WA requiring a Form 5 and approximately 118 tenement will be audited each year.

Auditing

DMIRS have quite a good explanation about auditing Form 5s in DMIRS Auditing of Reports.

One particular statement is worth breaking down, that is:

“The audit statement must state that on the basis of the information/evidence provided to him/her by the tenement holder, the expenditure being claimed on a particular tenement in the Form 5 was (or was not) in fact incurred or caused to be incurred by the tenement holder in the relevant expenditure year.“

The Tenement Holder needs to provide information and evidence of any expenditure, thus a process for collecting evidence, eg receipts, and collating expenditure eg Excel spread sheet or accounting software. As an aside, a programme called Expenditure Watch provided by LandTrack Systems has been approved by auditors as suitable for collating data for Form 5s.

Setting up accounts is a common problem we come across as the accountants (having little working knowledge of the reporting requirements) set up the accounts with no reference to individual tenements and reference only projects or the company. Then when Form 5s are required, a substantial amount of creativity is required,and if you are hit by an audit request the trouble begins.

Prospecting Documentation

The auditors really face problems of being shown evidence when a tenement holder prospects on their tenement with no real evidence of the prospecting, perhaps just a couple of fuel receipts travelling to site.

A couple of things can be done to demonstrate prospecting are:

- Keep time sheets and document the tenements on the time sheet

- Diarise daily the activity undertaken on the tenement.

- Keep a log book in the vehicle and document all travel including the tenement

- Put a tenement number/ project on all receipts

- Everyone has a GPS, so turn on the tracking and save it to files

- Take photographs with date and GPS stamps

The auditor does not need to determine that the expenditure reported is claimable only that a process is in place to capture it. However, it is advisable to be familiar with what is claimable and not claimable, and the little idiosyncrasies that exist. And there are quite a few.

Results of a Failed Audit

The DMIRS website (previously referred to) itemises the possible results of an Audit. In summary:

If the Auditor states the amount on the Form 5 is correct no further action will be taken.

If the audit amount shows a shortfall in Form 5 amount to the required expenditure, DMIRS will issue a Notice of Intention to Forfeit, the party has 30 days to respond. Failure to provide a good excuse will mean loss of the tenement.

A couple of points to watch. If your Form 5 expenditure is marginal, instead of doing creative accounting, lodge an Exemption from Expenditure and lodge it for the total expenditure on the tenement, (not just the amount of shortfall) so it is immaterial if the audit finds a shortfall in expenditure.

Advantages of Documentation

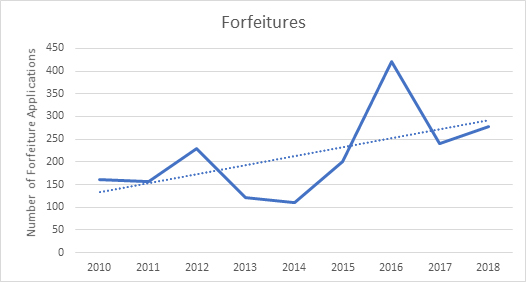

Advantages of having your expenditure documentation in good order it is also a good defence against Application for Forfeitures (AF) from other parties in the industry. Below is a graph of AFs by other parties against tenure each year since 2010. Note that that there is an increasing trend line, which demands that your prospecting documentation is even more rigorous.

Conclusion

So we have more than 2% of all tenement expenditure being reviewed by either auditors or by other parties so it is imperative you have your tenement expenditure documentation in order.