This story has evolved over the last 10 years, it demonstrates how impractical the Mining Act can be and how it fails to allow sufficient latitude when a development is of prime importance to the State.

It also shows that one must act prudently in the mining industry, undertaking proper due diligence and giving careful consideration to the circumstances. Due deliberation is essential when formulating sale agreements or, as will be demonstrated, it can cost millions.

The year was 2014, Convergent Minerals Ltd owned the Mt Holland Gold Project with several subsidiary companies. They were the registered holders of the tenements where the undiscovered Earl Grey Lithium Deposit was located.

Convergent wanted to develop the Blue Vein mine, the Pre-Feasibility Study showed it contained 128,504 oz of gold and had an undeveloped value of $10M. This would deliver $179M over 3 years with a production cost of AUD$1188 per oz.

At the time when raising money on the stock market was an impossible task, Convergent took out a $2.5M bridging finance from Capri Trading Pty Ltd (directors being Mr and Mrs Kinghorn) to develop the project, intending to raise $43M on the market.

Failing to raise the money, Convergent defaulted on the payments. This resulted in Convergent and their subsidiaries, including Montague Resources Ltd, going into voluntary administration.

Convergent’s exploration expenditure was minimal on tenements in the Mt Holland Project other than the Blue Vein mine tenement. Objections to exemptions from expenditure, as well as forfeiture applications (‘Applications’), were lodged on 13 of the 56 tenements that formed the Mt Holland Gold Project. These were lodged on 2nd October 2015 by Phoenix Rise Pty Ltd and Jeffery Hull.

Phoenix Rise was registered as a company a mere 3 days before the Applications were lodged. The directors of this newfound company were Narelle Anne Graham and Paul Montague Williams. Mr Williams was a founding director of the above-mentioned Montague Resources for approximately 5 years, leaving around the time Convergent listed in 2007.

In respect to the Applications, if the Warden decided in favour of Phoenix Rise and Mr Hull, the final decision would be referred to the Minister. Should the Minister decide in their favour, they could apply for the tenements in their own names over the same area as the tenements.

Mt Holland Tenements with Forfeiture Applications

Now enters Martin Donohue, the managing director of Kidman Resources, buying into this mess at a bargain. He purchased the Mount Holland Project from receivers in 2016 for an initial $2M with a future payment of $1.5M. The onus was now on Kidman to defend the Applications. Reportedly, Kidman put aside $450k to fund the defence of the Applications.

Martin Donohue is no stranger to controversy. In his past life as a stockbroker, he forged his stepmother’s signature and was banned from stockbroking and offering financial advice. He worked decades to rebuild his reputation by building up Kidman Resources and didn’t seem to be put off by the opportunistic Phoenix Rise.

When Kidman bought the Mt Holland Project, the company was short of cash. Shares were at $0.09, and no funds were available for exploration. The market was still tight for raising capital, even though they did managed to raise enough to make the purchase.

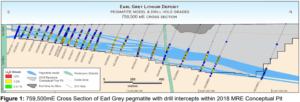

Luckily for Kidman, they didn’t need to drill the first discovery hole through the lithium bearing pegmatite vein, it was drilled by the previous owner and bags of reverse air core drilling chips were left lying on the ground. A couple of bright geologists sampled them and sent them for assaying, the results showed 1.5% lithium. Break out the champagne!

The lithium bearing pegmatites were traced back to the surface for 1.5km resulting in a 190 million tonne, high-grade lithium deposit.

In November 2016, Marinda Metals Ltd appeared out of the woodwork, stating their interest in the Mount Holland Project. The claims were prompted by an exchange of five emails and three text messages between Managing Directors of the respective companies earlier that year. Kidman wholly refuted that these claims amounted to any binding agreement. Donohue was chasing sheep around his farm in Victoria during the exchange and Kidman chalked these chats up to being preliminary negotiations.

Kidman was wrestling a few problems bigger than sheep now. They must defend the Marinda Metals litigation and the Applications, all while raising money to fund exploration. Any sale or joint venture with the Mt Holland Project tenements was dependent on resolving these matters.

Fortunately, in the case of Marinda Metals, the Supreme Court agreed with Kidman.

In the case of the Applications, Kidman was not so lucky. The Warden decided in favour of Phoenix Rise and Hull. (This decision will be analysed in a later blog).

However, Kidman had become the centre of attention in the lithium world. They were being approached by the biggest players in the game, including Albemarle, the Chinese and Sociedad Quimica y Minera de Chile (SQM).

SQM proposed a joint venture with Kidman. With the promise of downstream processing to build a lithium refinery in Kwinana, they received strong support from the WA government. This paved the way to securing the Kwinana site and the off-take deals with Tesla, Mitsui and LG Chem.

Wesfarmers would eventually approach Kidman, wanting to purchase their 50% share of the Mt Holland Project, eventually paying $1.90 a share to the shareholders which totalled approximately $700M.

The purchase by Wesfarmers was conditional on Kidman settling the Applications with Phoenix Rise and Jeffery Hull.

Just imagine the leverage Phoenix Rise and Jeffery Hull had in the negotiations with Kidman at this point. In late 2018, Kidman announced a settlement of the Applications by issuing over 5 million shares to the parties.

Phoenix Rise and Hull would have received $1.90 per share (Wesfarmers bid price) for a total $9,865,736.

The settlement with Phoenix Rise and Mr Hull triggered project milestone payments from SQM, US$85 million (AUD$117.75m ). US$25m went directly to Kidman and US$60m to the joint venture entity, Covalent Lithium.

The joint venture partners selected a Kwinana site for the lithium hydroxide plant. This 45,000 tonne-a-year plant is a short distance from China’s $700M Tianqi plant, which is already under construction.

Martin Donohue retired comfortably, $10 million richer. He’s now farming his property in Victoria after having grown Kidman market capitalisation from $8.9 million to $776 million.

Analysis of the events

Mt Holland Lithium project is a substantial economic benefit to Western Australia with construction costs of $1.8 billion. Providing approximately 50,000 tonnes of lithium per annum, at current prices that is over AU$5 billion per year. Estimated growth rate in the long term is 20% a year.

For the State to be willing to lose the billion-dollar Mount Holland Lithium project over the $152,337 lack of expenditure in 2014, something must be seriously wrong with the Mining Act and its processes.

It allowed a couple of in-the-know opportunists to essentially compel Kidman into paying nearly $10M to finalise the sale to Wesfarmers.

This is not an uncommon occurrence in WA. The State Government should rectify the Mining Act so that companies are not paying thousands in lawyers’ fees to defend their tenements from opportunists.

This does not occur in any other State, nor does it operate in any other government department in WA. The EPA does not have opportunists running around, suing people for breach of environmental conditions. The State is evading its responsibility of governing the mining industry, leaving it in the hands of the self-serving.

A company that holds tenements and operates in WA should be critically aware of its tenement expenditure – past, present and future. They must meet all tenement commitments or have reasons for not being compliant pursuant to the Mining Act. As shown, having a laissez-faire attitude and defending breaches is proven to be very expensive.

Undoubtedly, many shenanigans occur in the WA mining industry. It is essential to review the history of dealings and undertake proper due diligence on tenements before purchasing projects or entering joint ventures. Not to say that Kidman wasn’t fully aware, but a settlement may be more costly than expected.

To assist the mining industry to undertake due diligences on mining tenure in WA, LandTrack Systems developed the LandTracker Due Diligence Pro. This software increases speed and accuracy, providing all the data gathered for multiple tenements from Mineral Titles Online and Tengraph in an Excel spreadsheet. Transforming several weeks work into minutes.

For further information see: LandTracker Due Diligence Pro