Exemption from Expenditure under COVID-19

If you think that the State Government’s announcement on Covid-19 is a get out of jail card for reduced exploration expenditure, you are mistaken.

COVID-19 has decimated funding for exploration, though a couple of companies have managed to fund raise on the markets. Despite the Federal Government relaxing insolvency laws and allowing insolvent trading, the State government’s main changes that affect the mining industry are:

- imposing travel restrictions;

- allowing additional time to pay tenement rent using existing mechanisms; and

- granting relief from expenditure on exploration.

It is the latter that is somewhat like the emperor’s new clothes, looks great at first glance but lacks substance.

An Application for an Exemption from Expenditure

The State Government is allowing for an exemption from exploration expenditure (until 31 March 2021) unless rescinded earlier, if tenement holders are unable to meet the tenement’s expenditure requirements as a direct result of COVID-19 or because of restrictions imposed by the State and Federal governments.

Applications are made through the Exemption from Expenditure application process.

It may sound like it will relieve stress. However, it is less than adequate for a number of reasons.

Firstly, it terminates on the 31 March 2021. If the lockdown, the travel restrictions or limited funding persists for another 6 months (a conservative figure), any tenements that have an anniversary from 31 March 2021 to 30 September 2021 will not gain its benefit even though the majority of the 12 month period is within the COVID-19 infection period. Furthermore, if there are any exemptions that are required in the next 3 months, and you use the COVID-19 exemption reasoning, it may be refused because you previously had a significant amount of time to undertake exploration.

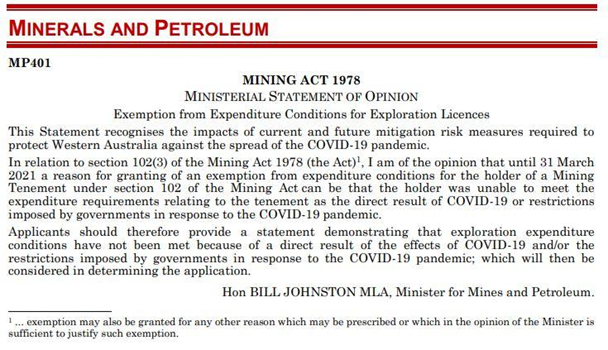

Secondly, the Minister Gazetted the COVID-19 Exemption (see below) and stated “it is my opinion”

The Minister is granting nothing that is not currently not available under the Mining Act. However, he is providing assurance there is a reason for an exemption under s102(3) of the Mining Act “any other reason which the Minister …considers sufficient to justify an exemption”. However, as it is written as a ‘statement of opinion’ and can be withdrawn as easily as is gazetted, relying on the opinion is risky. Also, if a person objects to the exemption application, the Warden’s decision must be within the law stated in the Mining Act and Regulations.

DMIRS on the 8th April 2020 released this following advice

https://www.dmp.wa.gov.au/Minerals/Exemption-for-Expenditure-5674.aspx

This DMIRS policy announcement (which is law pursuant to the regulations) is constraining the effect of the Ministerial Statement of Opinion, which puts us back to square one.

Thirdly, the State government has also restricted travel inter-state and between the following regions: Perth and Peel, South West, Great Southern, Goldfields-Esperance, Mid-West, Wheatbelt, Gascoyne, Pilbara, and Kimberley.

Exemptions from restricted travel apply for employment purposes, which includes mining and resource work. The State Government has launched an on-line system called ‘G2G WA’, which will cover both inter-state and intra-state travel exemptions. SME miners will be able to bulk upload their employee travel exemptions and should ensure they have all the information needed to comply with the upload requirements.

Therefore, using the restrictions on travel for an exemption from expenditure don’t apply unless you wish to access aboriginal lands.

Therefore, in light of the above, exploration will need to continue or demonstrated to be continued on WA tenements, unless it can be proved to DMIRS, in a statutory declaration that COVID-19 has halted exploration. How can this be done?

I would recommend that you document and diarise all significant dates, for example:

- when the governments commenced imposing restrictions, on the community;

- the delay taken (including time and dates) to obtain government consent;

- any infections suffered by employers (the Federal Government will have to release the infection into the community eventually or incur economic ruin while everyone is locked up while a vaccine is discovered and produced).

Lodge Programmes of Work (POW) on all tenements that require exploration expenditure.

For further help in these areas, attend LandTrack System’s Practical Tenement Management Interactive Online Learning . We will also be covering other methods to help you prepare for exemption from expenditure in the days of COVID-19.